- Joined

- Mar 20, 2019

- Messages

- 194

I am in the process of purchising a electric hydro. I am using paypal but dont want to use friends & family what percent extra should I include to cover the fees?

Right for the whole year not in 1 transaction.If you exceed $600 in sales transactions

It's my understanding that they stuck an amendment in the last omnibus bill making any 600. Any transaction. I've heard it's gonna put many small banks out of business with mounds of paperwork.Right for the whole year not in 1 transaction.

The $600 per transaction was buried in Biden's "covid relief" package in 2021, it took effect Jan. 1st of this year. Any peer to peer transaction (Paypal, Square, Venmo, CashApp etc.) over $600 will qualify for a 1099k unless it is friends/family but even those will be subject to scrutiny. They (Congress) are currently trying to undo that as they've realized it's a logistical nightmare but can't agree on new amount. Republicans want it to go back to the original 20k annual threshold but Dems want it 5 or 10k. It is not going to happen in time for the 2022 tax year but hopefully fixed for 2023. In the meantime keep all your transactions under $600 if you can (like splitting up payments) and hope for the best........It's my understanding that they stuck an amendment in the last omnibus bill making any 600. Any transaction. I've heard it's gonna put many small banks out of business with mounds of paperwork.

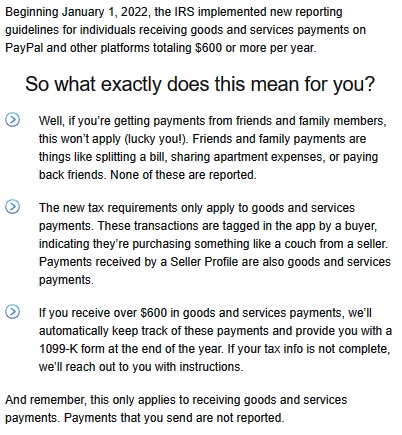

That 20k/200 transactions number was history as of 1/1/2022, business transactions totaling over $600 for goods or services gets reported to the IRS-This is from PayPal’s page. It is BS as 90% of what we sell is for less than we paid. But hey Biden said if you make invader $400k you won’t pay more taxes. Lmao

This change was introduced in the American Rescue Plan Act of 2021, which amended some sections of the Internal Revenue Code to require Third-Party Settlement Organizations (TPSOs), like PayPal and Venmo, to report goods and services transactions made by customers with $600 or more in annual gross sales on 1099-K forms. Currently, a 1099-K is only required when a user receives more than $20,000 in goods and services transactions and more than 200 goods and services transactions in a calendar year.

Yes but if you keep them under $600 and done as F&F it makes a huge difference. Even though they say F&F is excluded many tax specialists are saying an F&F transaction over $600 can still be reported and then it's up to you to explain that it wasn't for goods or services.............It is $600 in annual gross sales not each transaction over $600.

Enter your email address to join: